The state of DataOps in manufacturing in 11 stats

Torey Penrod-Cambra

is the Chief Communications Officer of HighByte, focused on the company's messaging strategy, market presence, and ability to operationalize.

All eyes are on manufacturing these days. Global leaders see manufacturing as the engine powering a wide range of initiatives—from infrastructure development to energy efficiency. Their focus on industrial growth and sustainability shouldn’t be surprising when you consider that manufacturing accounts for roughly 17% of the global GDP and 23% of direct carbon emissions. The reprioritization of industrial investments around the world is good news for manufacturers.

Are you ready for the bad news?

Manufacturers lag other sectors by a significant margin when it comes to data management.

Enterprise Strategy Group (ESG), a division of TechTarget, surveyed 403 technical and business data professionals at organizations in North America to assess the state of DataOps in 2022. They defined DataOps as “improving the quality, delivery, and management of data and analytics at scale.” The study looked at market maturity, challenges, factors influencing buying and planning decisions, and business benefits among those surveyed.

The findings were telling.

95% of manufacturing organizations indicate they’re struggling with their data management and analytics initiatives. Manufacturers’ problems with data management are putting them at a competitive disadvantage. Just 28% of manufacturers believe their DataOps strategy is very effective compared with 57% from other industries. In addition, only 38% of manufacturers believe they exceed their peers or competition when it comes to leveraging data analytics vs. 61% from other industries.

So, what now?

So, what now?

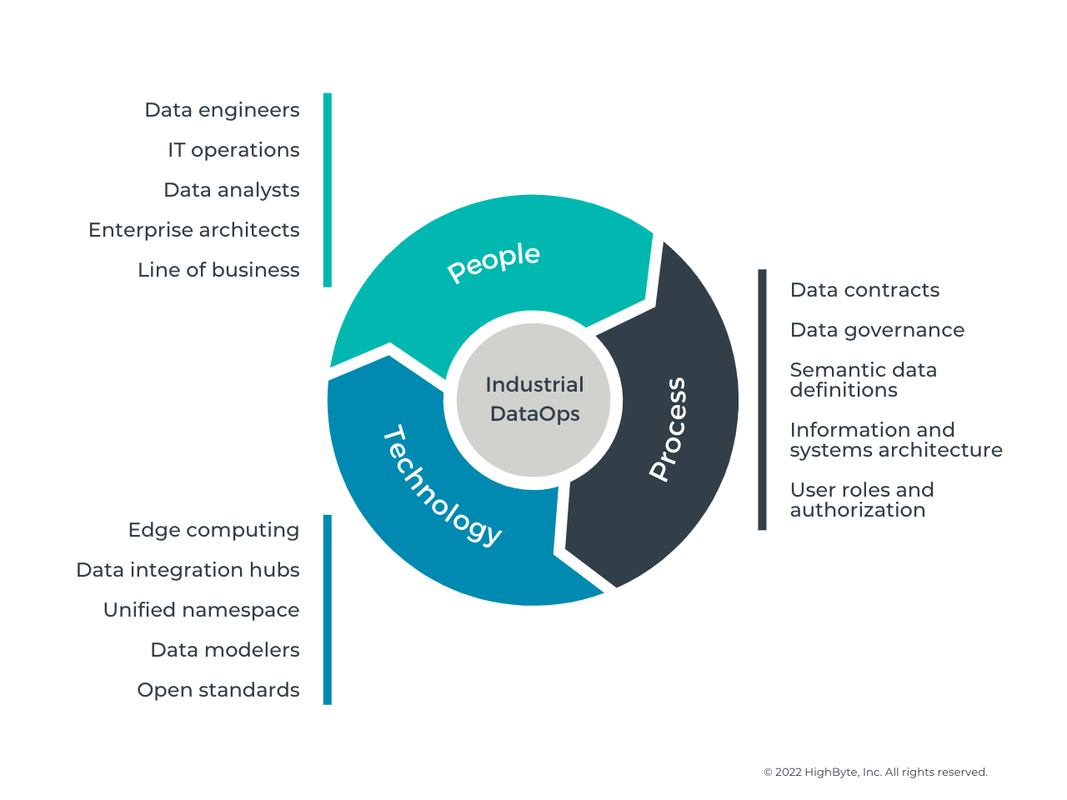

People, Process, and Technology

An effective DataOps strategy requires the orchestration of people, process, and technology. Only with these three elements working in concert can we deliver trusted, business-ready data to users and systems that require it.

Let’s look at other findings from the survey across these three elements. The results reveal a roadmap for improvement.

People

Only 16% of manufacturers indicated they have significantly increased end-user access to data within their organization over the last year compared to 47% of respondents from all other industries. Without real-time insights, meeting new productivity demands, improving product quality, reducing cost of operations, and outperforming competition becomes virtually impossible in an Industry 4.0 world.

In some cases, manufacturers are trying to solve their data management problems with solutions that may not be practical or even more challenging. For example, 42% of manufacturers say they plan to hire more people to address ongoing data integration challenges compared to 34% in all other industries. Adding more talent is costly and may not be easily accomplished given the current skills shortage.

The findings demonstrate a need to prioritize DataOps within manufacturing enterprises. For instance, only 60% of manufacturers have a formal data operations team compared with 73% of respondents from all other sectors.

There is also the matter of burnout. IT Operations is disproportionally affected in manufacturing. In fact, 42% of manufacturers indicated that IT operations is more overburdened with DataOps strategy than any other job function within their organization—compared to only 16% for this role in other industries.

For manufacturers ready to address these shortcomings, here are a few questions to consider:

In some cases, manufacturers are trying to solve their data management problems with solutions that may not be practical or even more challenging. For example, 42% of manufacturers say they plan to hire more people to address ongoing data integration challenges compared to 34% in all other industries. Adding more talent is costly and may not be easily accomplished given the current skills shortage.

The findings demonstrate a need to prioritize DataOps within manufacturing enterprises. For instance, only 60% of manufacturers have a formal data operations team compared with 73% of respondents from all other sectors.

There is also the matter of burnout. IT Operations is disproportionally affected in manufacturing. In fact, 42% of manufacturers indicated that IT operations is more overburdened with DataOps strategy than any other job function within their organization—compared to only 16% for this role in other industries.

For manufacturers ready to address these shortcomings, here are a few questions to consider:

- Do I have the right cross-functional team to accomplish our goals?

- Do I have the resources (human and financial) I need to be successful?

- Is this initiative a priority, driven from the top down?

Process

Manufacturers realize they need data to become more efficient. In fact, 68% of manufacturers responding to the ESG survey cite operational efficiency as the top business objective driving their data strategy.

The problem lies in execution. Traditionally, data preparation and orchestration has been tied to transactional data rather than operational data from machines, processes, and products. Perhaps that’s why other sectors, such as finance, are more mature when it comes to their DataOps strategy.

Furthermore, 25% of manufacturers say resistance to change and cultural differences are major barriers they face in their DataOps strategy compared to only 19% in other industries.

To address these challenges, here are a few questions to consider:

The problem lies in execution. Traditionally, data preparation and orchestration has been tied to transactional data rather than operational data from machines, processes, and products. Perhaps that’s why other sectors, such as finance, are more mature when it comes to their DataOps strategy.

Furthermore, 25% of manufacturers say resistance to change and cultural differences are major barriers they face in their DataOps strategy compared to only 19% in other industries.

To address these challenges, here are a few questions to consider:

- Do we have alignment on use cases, data sources, and requirements of end applications?

- Do we have the right system architecture that will allow us to scale?

- Does our company culture promote data democratization and real-time action on insights by operators?

Technology

Technology is not a cultural Band-Aid, but it can help address some of the challenges experienced by People and Process. Unfortunately, 64% of organizations have significant room for growth when it comes to implementing DataOps technology—and manufacturing is slightly behind the curve.

The message from the ESG survey is clear: If manufacturers want to leverage the full potential of data analytics, they need to adopt DataOps as a core part of their overall digital transformation strategy. Once manufacturers have a solid plan in place, they need data modeling solutions that can automate IT/OT integrations and then standardize and contextualize that information in real time, so operations can focus on their core responsibilities, and IT can deliver information to line of business without burnout.

The good news is that 97% of manufacturing organizations are benefiting from improved access and usage of data for outcomes like supply chain optimization and predictive maintenance. So making improvements across People, Process, and Technology is well worth the effort.

Here are a few final questions for you:

The message from the ESG survey is clear: If manufacturers want to leverage the full potential of data analytics, they need to adopt DataOps as a core part of their overall digital transformation strategy. Once manufacturers have a solid plan in place, they need data modeling solutions that can automate IT/OT integrations and then standardize and contextualize that information in real time, so operations can focus on their core responsibilities, and IT can deliver information to line of business without burnout.

The good news is that 97% of manufacturing organizations are benefiting from improved access and usage of data for outcomes like supply chain optimization and predictive maintenance. So making improvements across People, Process, and Technology is well worth the effort.

Here are a few final questions for you:

- Do we have alignment on how we will select and deploy technology at the plant and enterprise level?

- How much autonomy does/should each facility have for technology selection?

- Do we have an actionable data governance plan?

Additional Resources

If you’d like to learn more about the State of DataOps, you can download the eBook discussed in this post.

I also like this post from my colleague John Harrington, DataOps for manufacturing: A 4-stage maturity model. The post breaks down team, data handling, and data structure parameters for each stage in the model.

I also like this post from my colleague John Harrington, DataOps for manufacturing: A 4-stage maturity model. The post breaks down team, data handling, and data structure parameters for each stage in the model.

Please contact us if you have any questions about these resources or would like to learn more about HighByte Intelligence Hub, a DataOps solution built for industrial data.

Get started today!

Join the free trial program to get hands-on access to all the features and functionality within HighByte Intelligence Hub and start testing the software in your unique environment.